wa state long term care payroll tax opt out

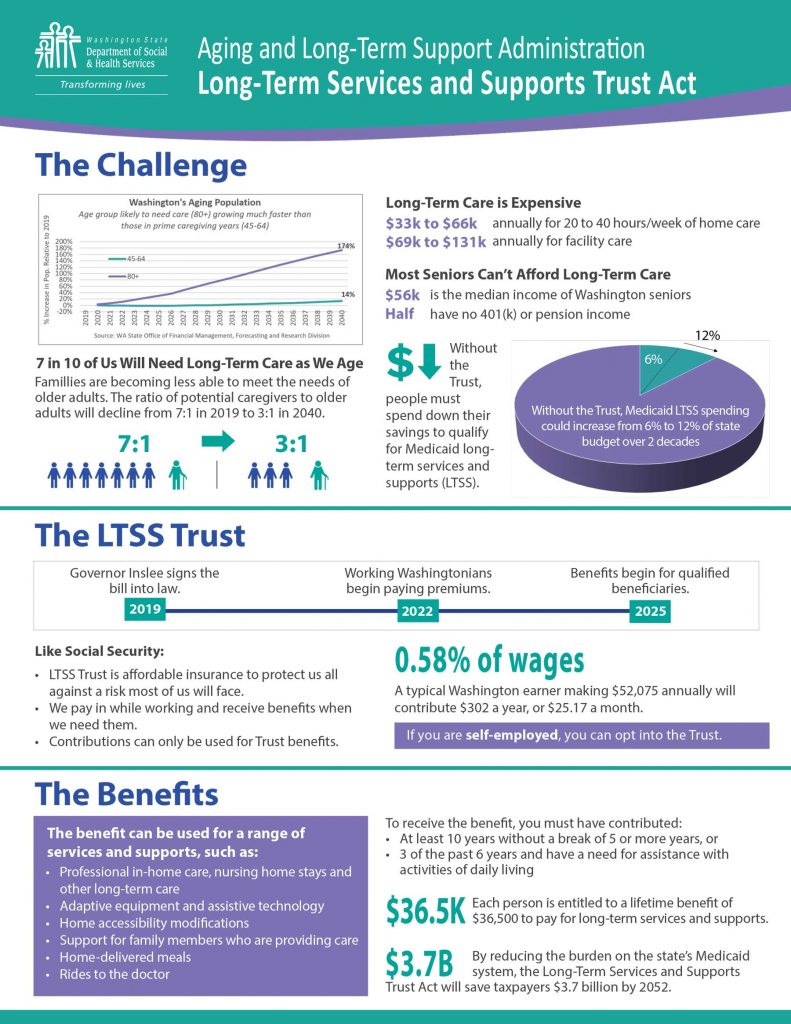

Medicares coverage for long-term care is very limited while Medicaid generally requires people to impoverish themselves before it picks up the tab. Many of the states employers quickly offered workers the opportunity to buy private plans.

New Wa Long Term Care Tax Delayed So Legislature Can Fix It Crosscut

Jay Inslee signed legislation.

. Workers already approved for a permanent WA Cares exemption because they hold a long-term care insurance plan do not need to reapply. Monday is the deadline to have your private long-term care insurance plan in place in order to opt out of. 1 to opt out of the states long-term care program which will help pay for nursing care and other support services for people who can no longer care for.

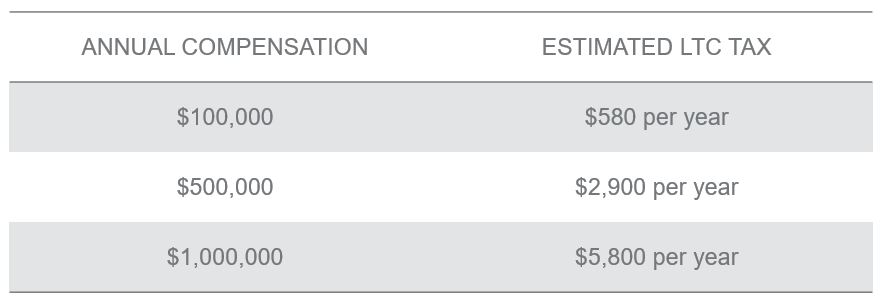

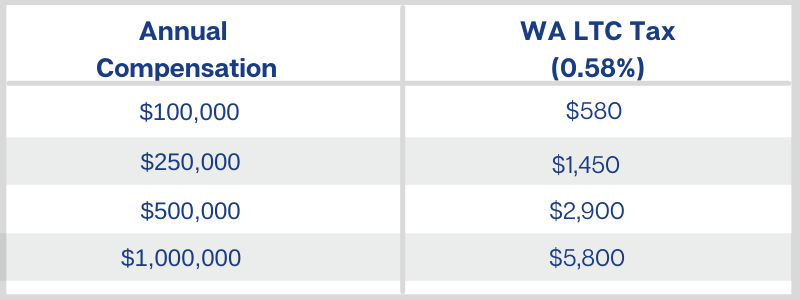

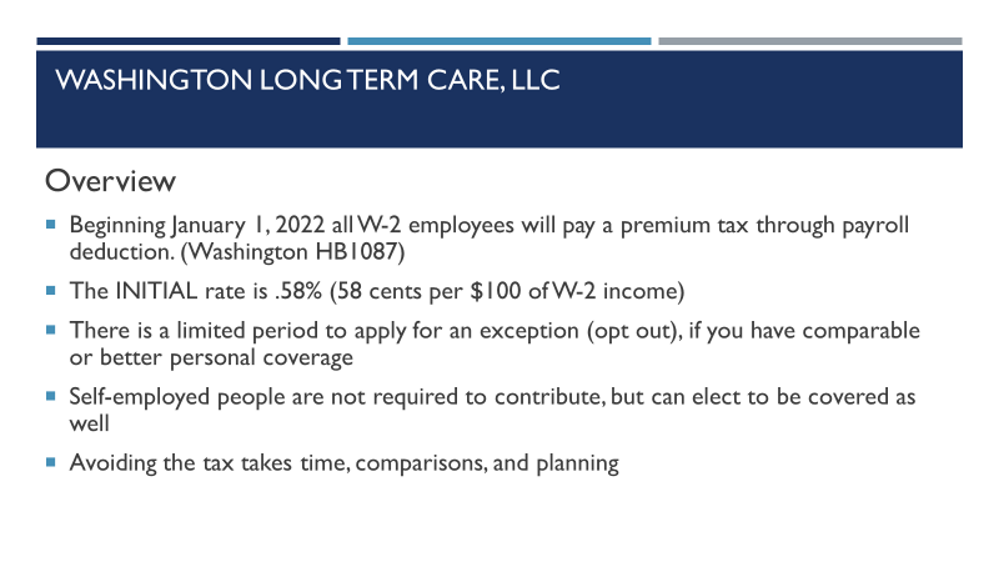

1 2021 opt-out deadline. Washington state is implementing a new 58 payroll tax on all W-2 employees who work in-state. Military spouses can opt out.

Palouse Country Assisted Living administrator Helda. 1 2021 opt-out deadline. The Washington Cares Fund collects 58 cents for every 100 of income that workers in the state earn until they retire.

As of January 2022 WA Cares Fund has a new timeline and improved coverage. The State of Washington has now opened their online opt-out procedure for those who have qualifying Long-Term Care Insurance and wish to be exempt from the upcoming payroll tax. October 31 2021 at 924 pm PDT.

1 2022 employers will begin withholding a new payroll tax from employee paychecks as a premium payment for the new long-term care benefit. 1 to opt out of the states long-term care program which will help pay for nursing care and other support services for people who can no longer care for. 1 2023 exemptions granted to military spouses non-immigrant visa holders and those living outside Washington will not be permanent.

Any employee who attests that they have comparable long-term care insurance purchased before November 1 2021 may apply to ESD for an exemption from the premium assessment. Turns out they were a bit premature. You must purchase your own policy prior to November 1 2021 to opt out of this payroll tax.

The employee must provide proof of their ESD exemption to their employer before the employer can waive. You need to already have or purchase a long-term-care plan through a private insurer by Nov. The WA Cares Fund would help alleviate the financial burden of long-term care by providing workers a lifetime benefit of 36500.

Due to the overwhelming demand for LTC insurance in Washington policies likely will no longer be issued in time to meet the states November 1 2021 deadline. 2 days agoWorkers could get an exemption if they had private long-term care insurance and thousands of people scrambled for that coverage before the Nov. Washingtons first-in-the-nation law creating long-term care benefits for residents who pay into a state fund wont start payroll deductions until 2023 after a retooling this year according to.

Washington workers have until Nov. At least now we know how fast after legislative action taken last night on Substitute House Bill 1323. Workers who live out of state can opt out.

Workers on non-immigrant visas can opt out. 5 hours agoThe commission overseeing the long-term care program has estimated that the number of people from these groups eligible to opt out is about 264000. After months of backlash governor Jay Inslee recently signed a pair of bills to delay and amend the tax for Washingtons long-term care program.

Part of that bill distorts a two-year old law giving Washington residents only until November 1st to opt out of a state program that will tax. News WA Government With opt-out deadline looming Washingtons long-term care benefit and tax draws praise criticism. Patricia Keys 71 and a stroke survivor needs help with many everyday activities such as dressing and bathing.

If you want to opt out of a payroll tax that begins in January assessed to fund a state-run one-size-fits-all long-term-care-insurance fund that you might or might not benefit from read more about the coming tax on our Center for Health Care blog here is what we know. This new fund was created by the State Legislature to. Individuals who have private long-term care insurance may opt-out.

Near-retirees earn partial benefits for each year they work. 1 day agoWashington state retools first-in-nation payroll tax plan for long-term care costs The WA Cares Fund would help alleviate the financial burden of. The WA Cares Fund.

The date has arrived. Washington workers have until Nov. Veterans with 70 disability can opt out.

The initial premium rate 058. 1 day agoWorkers could get an exemption if they had private long-term care insurance and thousands of people scrambled for that coverage before the Nov. Opting back in is not an option provided in current law.

Washington state retools a first-in-nation payroll tax plan for long-term care costs. The program was delayed while lawmakers addressed equity issues. Many of the states employers quickly offered workers the opportunity to buy private plans.

Before we outline the process lets review some details about the new WA Cares Fund. Workers may need a financial planner and to get some quotes from long-term care insurers but they need to act fast.

Ltca Long Term Care Trust Act Worth The Cost

Despite Reports Washington S Long Term Care Tax Could Start Jan 1

Updated Get Ready For Washington State S New Long Term Care Program Sequoia

Washington State S New Payroll Tax Ignore At Your Own Peril Joslin Capital Advisors

Washington State Long Term Care Trust Act 0 58 Payroll Tax 36 500 Lifetime Maximum Benefit Page 8 Bogleheads Org

Can You Opt Out Of State S New Long Term Care Act And Tax Should You

Washington State Long Term Care Payroll Tax Steadfast Insurance

Making Sense Of Washington S New Long Term Care Law Parker Smith Feek Business Insurance Employee Benefits Surety

Washington State Long Term Care Act Update Parker Smith Feek Business Insurance Employee Benefits Surety

Washington State Long Term Care Tax Avier Wealth Advisors

Washington Long Term Care Tax How To Opt Out To Avoid Taxes

Washington State Long Term Care Tax What You Need To Know North Town Insurance

Washington State Long Term Care Tax Here S How To Opt Out

-1.jpg?width=565&name=WA%20Trust%20Act%20Tax%20(based%20on%20salary)-1.jpg)

Washington State Is Creating The First Public Ltc Plan Who S Next

Payroll Washington Long Term Care Llc

Want To Opt Out Of Washington S New Long Term Care Tax Good Luck Getting A Private Policy In Time Northwest Public Broadcasting

Wa State Long Term Care Is Really Acting Up Fair Free Flat Open

What You Need To Know About The New Washington State Long Term Care Act Coldstream Wealth Management

The Washington State Long Term Care Trust Act Opt Out Is Now Available Online Parker Smith Feek Business Insurance Employee Benefits Surety